The Day in the Life of an Operator

A Packet Story

Intro

Mindset

The following material is to take you through the mindset of an operator, rather than just WHAT IS an operator. To do this, we will take an adventure together to explore the inner workings of an operator and what drives them.

What is Telco?

Overview

Operator: "I look up to him [Regulator] because he is upper class, but I look down on him [end-user] because he is lower class."

End-User: "I know my place.”

For too long the telco world has been dominated by the push-pull mechanics of the operator exploiting the end-user and the regulator chasing their tail and over correcting.

For the UK competition in the operator space was opened up by the regulator in 2006 when OFCOM forced British Telecom (BT) to be separated into BT and Openreach.

In the US it was the break up of AT&T in 1982.

Whether it was a desired outcome of the regulators or whether it’s an organic byproduct; as the competition in the operator space ramped up, the end-user’s voice became more prominent and its fair to say that in the last 5-10yrs a operator is more driven by a end-user’s NPS score/ trying to keep a end-user’s ‘sticky’.

The negative side of this, is a race to the bottom on pricing (especially in the residential products), and so with slim margins, using traditional methods, that doesn’t leave a lot of room for high-end end-user service.

NetCo vs. ISPCo vs. Everything Else

What are these Co’s? And why does it matter?

NetCo

This is a organisation which operates a wholesale platform. Traditionally a NetCo is a natural host, and will not terminate an end-user/ subscriber session. They own and operate a network which facilitates the connectivity for the ISPCo’s. Typically they will be a Tier 1 or Tier 2 operator.

However there is a few sub-variants of a NetCo:

NHO

A natural host operator is an organisation which treats all of its customers (ISPCo) equally and fairly. It gives no organisation preferential treatment, and does not have any investment in any retail ISP’s/ customer’s (ISPCo’s).

Example - CityFibre

Vertically Integrated

This is where a NetCo strays from the neutrality, and the NetCo will have an investment in retail ISP’s/ customer’s (ISPCo’s).

Examples - Vodafone, Zen, Sky … etc.

ISPCo

Is a retail brand which requires the services of a NetCo in order to service its end-users/ subscribers. The ISPCo will terminate the subscriber session(s). It will have Autonomous System Number (ASN), RIPE entries, DNS servers … etc.

Examples - Plusnet, EE, TalkTalk (now separated from PXC) … etc.

There is also one sub-variant of an ISPCo:

vISPCo

This is a virtual ISP which is just a white labelled brand in order for said brand/ organisation to diversity its income. The organisation will let out its brand to an ISPCo/ Integrated NetCo

Examples - Post Office Broadband, Tesco’s Broadband, John Lewis Broadband … etc.

GlassCo

Is a organisation which solely provides 'glass’/ fibre. They might operate some optical repeaters in order to cover large distances, however they operate at layer 1 (physical) only.

Example - ITS.

OpCo

Is a management/ holding company for a set of Co’s either due to a shared investor or shared interests.

Why Does This Matter?

Differed Co’s have slightly different priorities, concerns and ultimately different stakeholders to satisfy.

Example

An end-user/ subscriber purchases a service from an ISPCo (TalkTalk), whom in turn purchases a service from a NetCo (PXC), whom in turn might purchase a service from a GlassCo (Openreach or CityFibre), and that only gets the connectivity to your door, the ISPCo then needs to purchase transit and peering … etc., to connect the end-user/ subscriber to the Internet/ the end-user’s/ subscriber’s favour content. And in order to do that, they need to purchase a service from a tier1 or several tier2 operators.

So the ISPCo needs to satisfy as many end-user’s/ subscriber’s as possible from tens of thousands to tens of millions, a NetCo needs to satisfy several ISPCo’s at anyone time and offer fairness/ neutrality. A GlassCo needs to get the connectivity to as many places as it is needed, all whilst satisfying landowners, government entities, the general public (whilst laying the new infrastructure) and keeping an clear, accurate and up-to-date record of where they’ve installed the new infrastructure.

By understanding a Co’s point of view, can help you leverage your position in the chain.

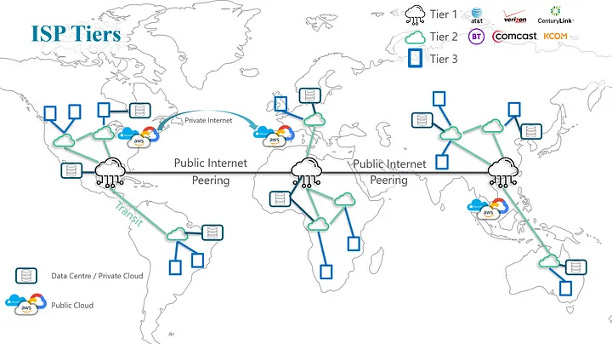

Tiers … what do they really mean?

The concept of ‘tiers’ these are used to signify the level of reach/ coverage that an operator has around the globe, region/ territory and/ or theatre.

Tier 1

This is traditionally seen as the ability to provide Global coverage, however in more recent times, it was re-used to mean that an operator had total coverage within country/ region/ territory and/ or theatre.

Fundamentally tier 1 has no upstream and does not pay another network to access other networks.

Global Examples:

Console Connect/ PCCW Global

Teila/ Arelion

Per Country/ Region/ Territory/ Theatre Examples:

Tier 2

Traditionally a T2 was the operator with total coverage within country/ region/ territory and/ or theatre, so there’s some cross over with T1 Per Country/ Region/ Territory/ Theatre.

However more recently a T2 has morphed into an operator with coverage in a specific sub-region/ sub-geographic area(s).

Overal a T2 needs to connect to a T1 at some point, either to cross a region/ territory and/ or theatre boundary, or get access to other networks via IP transit.

Tier2 Examples

Tier3

Finally there’s the T3 operators, who traditionally connect small discrete communities and/ or amalgamate several other operators connectivity to build an over the top (OTT) solution, i.e., MSPs offering SDN … etc.

View Points

Overview

The following content is to start putting ourselves in the various ‘shoes’ of the end-user/ subscriber, operator and regulator.

In the long-term however, most of these ‘mundane’ things need to be absolved or remediated to a point that it needs the minimal amount of human interaction.

An End-User/ Subscriber’s View

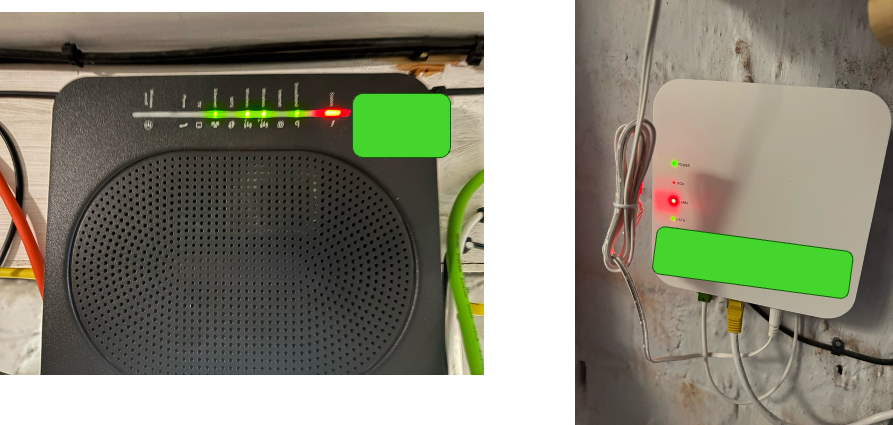

Q: What problem is being shown in this image?

A: The fact that an end-user had to look at their equipment.

A subscriber never touches/ looks at their ‘service’ until there is a problem, then they make it the operator's problem and without real-time clear data, they have to rely on, it’s the LED red or green?

One of the key frustrations of end-user’s is understanding the state of their service, and if it is being negatively impacted, when the service will be restored to the ‘acceptable’ level (or at least a level where they put up with it and/ or stop complaining).

An Operators View

Each operator battles daily with churn, end-user satisfaction and the over burdening regulator to try and strike a balance to stay a float.

Churn

The new paradigms of the new commercial realities (the competition factor from), has turned into a race to the bottom; especially in the residential (B2C) space.

Therefore margins per end-user are slimmer, so you need more end-user to balance your Cost of Goods and Sale (COGS).

However a new end-user also brings additional costs to ‘acquire’ them as a customer.

End User Satisfaction

And each end-user brings with them:

legal rights.

more social media accounts than anyone team can handle.

a complex set of requirements and environments.

Over Burdening Regulator

Whilst most regulators are like super tankers in terms of taking their time to make decisions, in the same vain they are also almost immovable objects, unless you’re a tier 1 (at least in your territory/ region/ theatre).

This means that for more operators, when the regulator says jump, you have to ask endless clarification questions to ask ‘how high?’, and ‘what for?’ .

A Regulators View

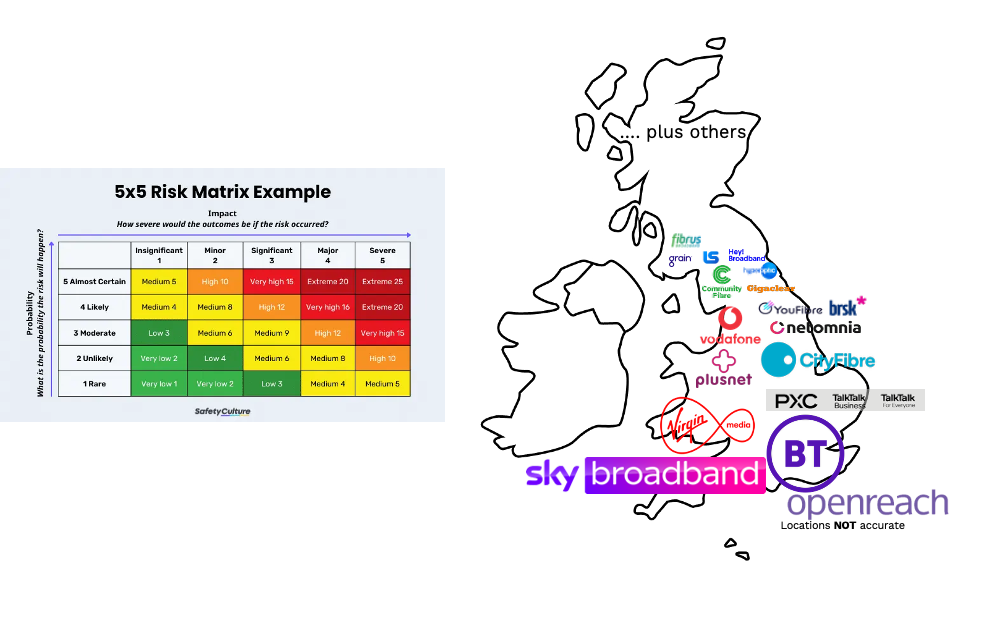

Apologies, trying to add all of the UK operators was too much for the image

A regulator will have hundreds if not thousands of operators to deal with at anyone time, coupled with millions/ billions of a region/ theatre/ territory end-users/ subscribers. And as each operator brings it’s own:

inherent risk/ likely hood of either taking themselves/ their end-user base offline and/ or the wider operator ecosystem in that region/ theatre/ territory.

market/ region to defend and/ or poach end-users from.

Key Considerations

Overview

Remember the following points are not easily solvable, however an enabler is to empower the operator to overcome/ automate the processes which frees the operator to look at the bigger picture quicker with more accurate data.

NetCo

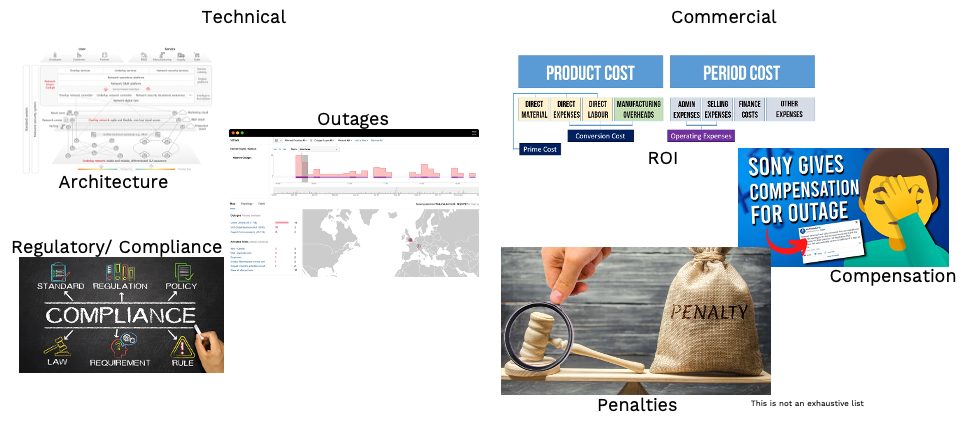

Technical

Architecture

Can the architecture support:

feeds and speeds?

features and capabilities?

product set(s)?

How will it be monitored?

Where will the alarms/ alerts be sent to?

What telemetry is available?

What does BAU operationalisation look like?

What are the Mean Time to Failure (MTTF) on the components used?

What is the upgrade plan?

When is the scaling point?

Outages

What is the allowed failure rate of the products?

Are maintenance windows included or excluded from the metrics?

Regulatory/ Compliance

What information must be shared?

How will the data be stored?

When will the data be accessed? (i.e., real-time vs. long term).

Who will access the data?

How will the data be audited?

Commercial

ROI

Does the product ‘wash it’s face’?

When will the product(s) be profitable?

Compensation

When is compensation triggered?

It is due to regulatory or good business practice/ product offering?

Are maintenances excluded?

What form is the compensation?

How will this affect cashflow?

Penalties

What are the penalties for non-compliance?

Financial.

Reputation.

How will this impact the future trading of the company?

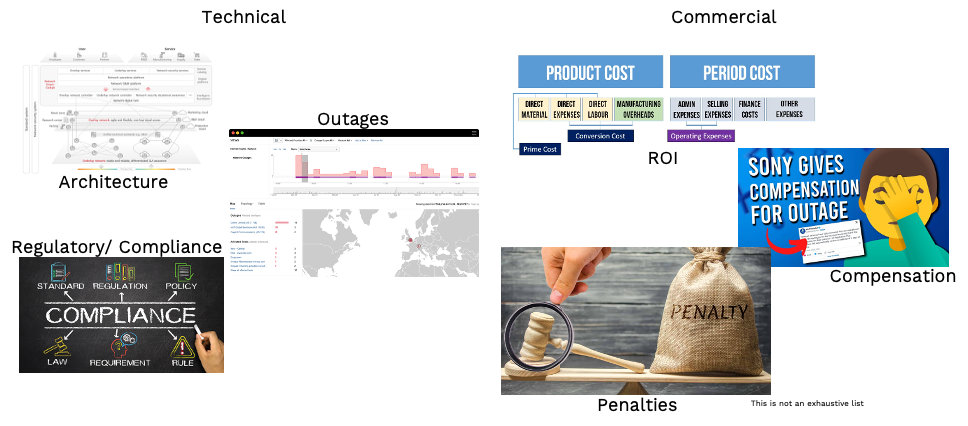

ISPCo

You’ll notice that an ISPCo’s considerations are pretty much the same as a NetCo’s, however with a different lense/ viewpoint (hence the lack of repetition below). As it’s the ISPCo which bares most of the risk and had to deal with the most upfront in order to gain, maintain and retain the end-user/ subscriber.

Technical

Products

Can the NetCo products support our Product Requirements?

What products do we need to offer to differentiate ourselves in the market and stay ‘sticky’ with the end-user’s/ subscriber’s?

Outages

What are the SLAs of the NetCo’s products?

How will we inform the end-user’s/ subscriber’s?

Regulatory/ Compliance

Same.

Commercial

Same.

Touch Points

Overview

So why is all of this important? And what on earth is this guy waffling on about?

As I said before understanding an operators mindset is about helping you understand the complexities of providing a modern, scalable and fit-for-purpose service to an evolving and ever demanding end-user’s/ subscriber’s.

The Key Changes

25years ago (in the UK at least), the consumer side of Internet was something new and fun, and we were willing to wait for webpages to load, minutes for videos to buffer and hours for files to download.

Fast forward to today, and the current generation are almost on a hair trigger to do a table flip if the connectivity to their app or stream drops a few frames (ok maybe I’m exaggerating a little bit here, however you get the gist).

An Operators Current Challenges

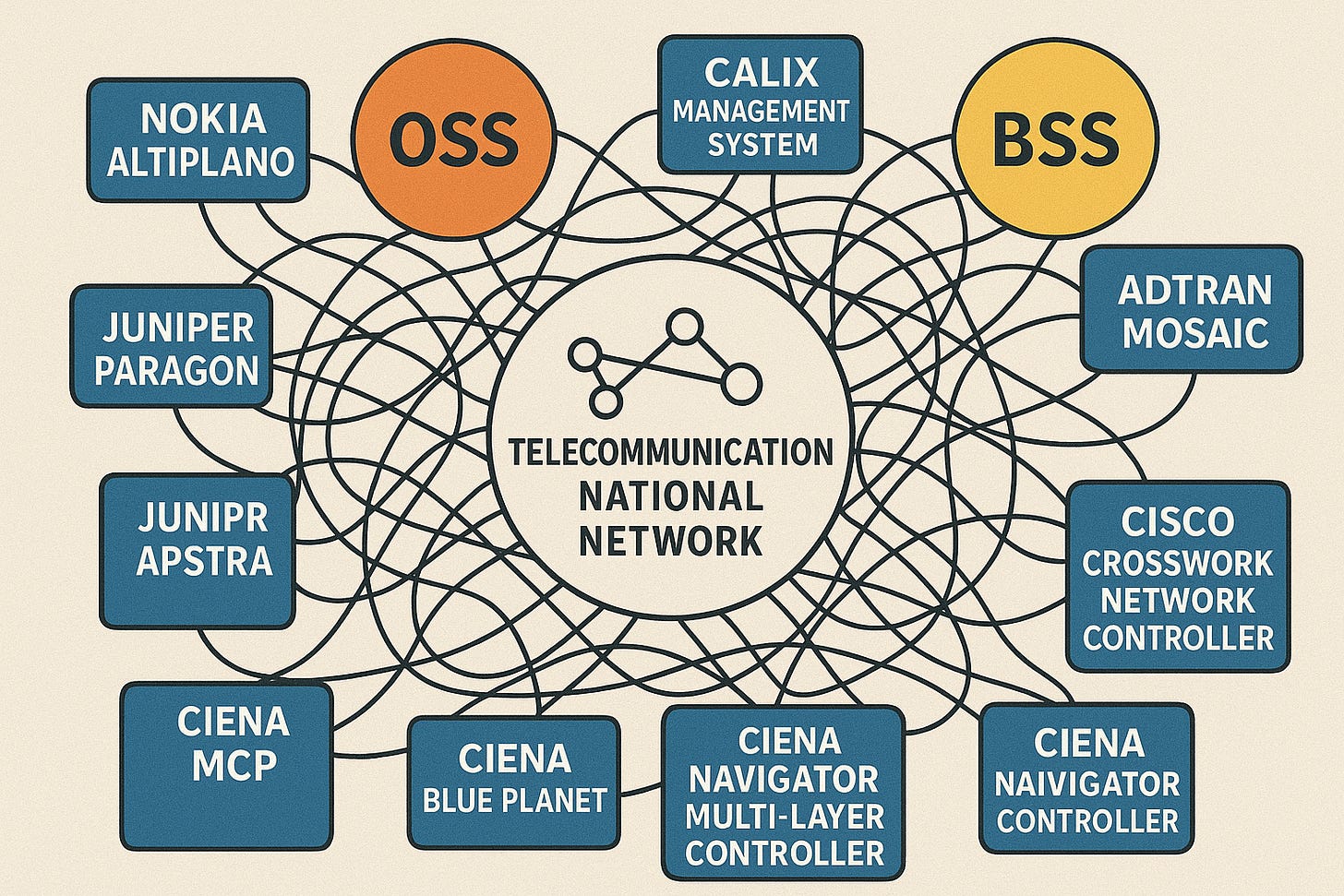

One of the many things that operators in general have been struggling to deal with the scale of is managing a network, and with scale comes more complexity.

Within the UK AltNet community and wider NetCo’s, balancing EMS, OSS and BSS systems can become a headache that can paralyse an operator or at least put a high enough barrier to stifle innovation and prevent/ diminish the end-user/ subscriber experience.

How Can An Operator Move Forward?

Having spoken to several of the UK based operators, one of the barriers to a utopian state (other than there’s no one system to rule them all … and in the darkness bind them) is two fold:

to have a clear understanding of the touch points and what that then means for their network(s).

to leverage the data to drive manful outcomes.

The TMForm are trying to create some standards around this, however I personally believe it can broken down into these key ares and the following high level topics:

Inputs

What is needed to drive the network?

Is it done via the Portal and/ or an API?

Outputs

What should/ needs to be captured?

How can it be standardised?

Feedback

How will the Outputs be interpreted?

How will the interpretations be used?

Accountability

Who will be responsible for implementation, monitoring, management, updating … etc.? (insourcing vs. outsourcing).

How will affect Mean Time to Repair (MTTR)? In reality for an operator its often Mean Time to Innocence (MTTI).

Summary

Remember an operator is under a high account of responsibility and accountability, and so moving to data driven outcomes and a customer centric mindset is not easy.

However more about how data is an operators king/ queen/ insert diaty of choice another day.